There are vast inequalities within the art world: while young artists compete for low-paying gigs, and small galleries struggle to break even, auction houses and other secondary market sellers make exorbitant profits and blue-chip galleries sell out their booths before an art fair opens. These unsustainable inequalities are the motives behind Collecteurs’ ethical considerations, as well as those of many other organisations advocating for fairer conditions for cultural workers. Proposals and ideas are consistently put forward to improve the working conditions of artists - the problem is in the implementation and longevity of these initiatives. One point that has been long proposed is resale royalties for artists. With the rise of NFTs (Non-Fungible Tokens), this long-standing proposal saw renewed interest as the proposal resurfaced into mainstream artistic discourse.1

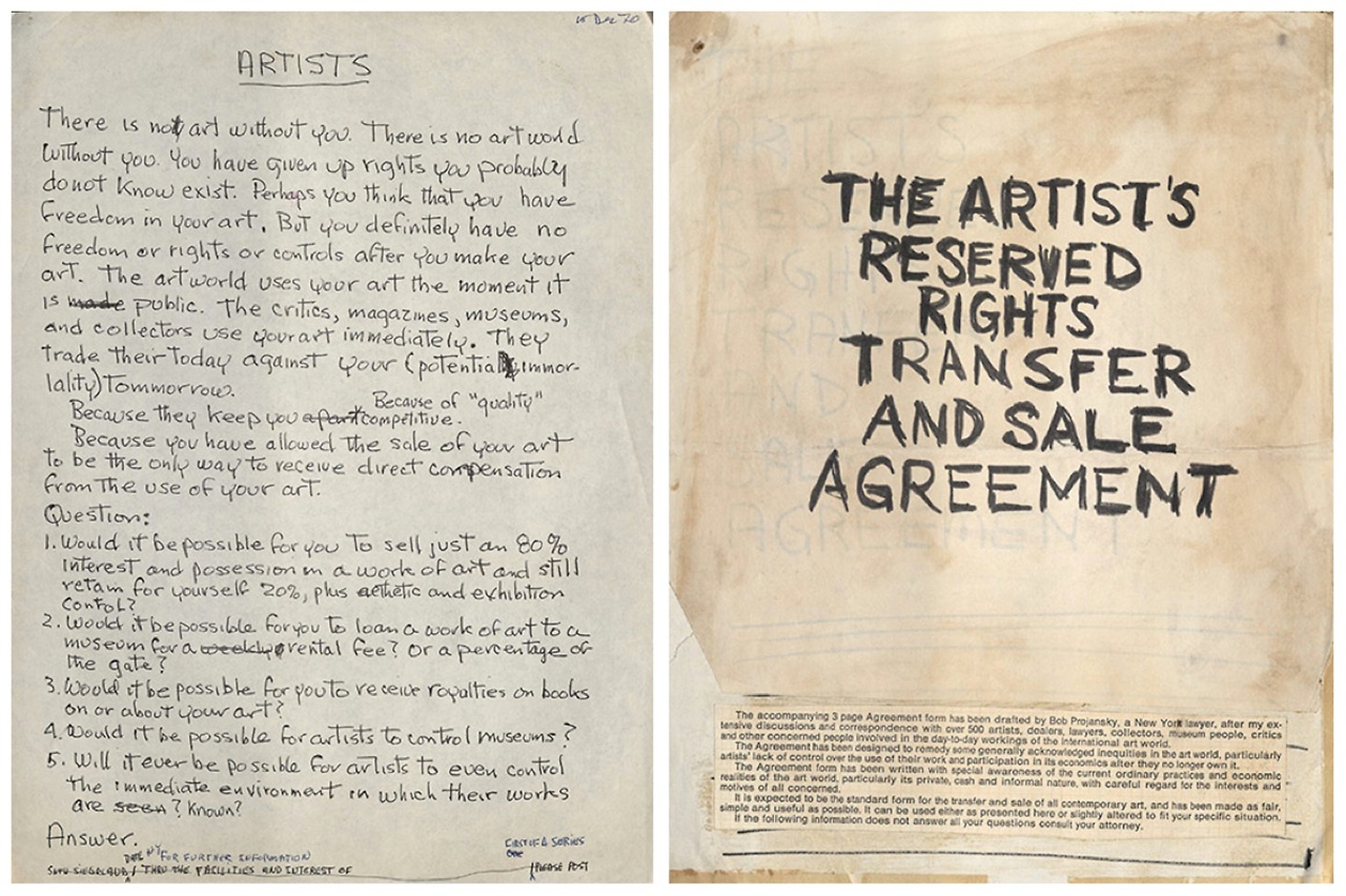

Appropriated Seth Siegelaub image dated 1969. Curator Seth Siegelaub published “The Artists’ Reserved Rights Transfer and Sale Agreement” which advocated for living artists to have greater control over the resale and exhibition rights of their work.

The initial embrace of artist royalties made NFTs attractive to digital creators and became one of the most exciting proposals for many makers. However, with a finance-oriented approach and intention, the collapse of the NFT market came as no surprise - since then, DABs (Digital Artworks on the Blockchain) have been proposed as an alternative which recognize the existence of this medium while referencing the history of Digital Art which extends back decades in time. Using the blockchain, DABs have the potential to continue generating passive income with each resale, meaning the creator would have a much more sustainable income. Although the resale royalties were presented as a major breakthrough, this concept dates back decades to the 1970s when the first wave of curators theorised on ethical principles for the artworld.

In 1971 the curator Seth Siegelaub and lawyer Robert Projansky published “The Artists’ Reserved Rights Transfer and Sale Agreement,” which advocated for living artists to have greater control over the resale and exhibition rights of their work. Article 2 of the agreement proposed a 15% artist royalty on all resales calculated from the increase in the sale price. Article 7 proposed that artists should have a veto right on the exhibition of their sold artworks. Both of these articles allow for the artwork to be bought and sold with autonomy by their owners while acknowledging that a work of art is a different kind of commodity than a piece of furniture or luxury car - it is necessarily the intellectual property of its maker. Resale values are a clear way to establish this distinction, but veto rights are another necessary proposal when it comes to works by living artists.

Seth Siegelaub, handwritten appeal to artists, 1970; mockup cover of The Artist’s Reserved Rights Transfer and Sale Agreement, 1971.

The issue with veto rights has come up repeatedly when art centres with questionable funding or political stances exhibit the work of an artist with differing political orientations. One such case was the Mediterranean Biennale held in Northern Israel in 20172. On this occasion, works by several artists who were active members of the Boycott Divestment and Sanctions movement3 (which aims to pressure the state of Israel to comply with international law), were loaned to the biennial by intermediary institutions who had bought the artists’ works. The artists were never consulted about these loans since the loan requests went directly to the institutions that housed their artworks. Regardless of the absence of veto rights in the contract, several artists got in touch with those institutions asking for the works to be removed. Using blockchain to incorporate veto rights for artists should not be considered as a limitation to the artwork, but as a way for the artist to stay informed and involved with the life of their own artworks, including institutional requests and contracts accessible through the blockchain.

Resale royalties respect the continuity of authorship through financial means, as they return monetary value to artists that have gained market demand through decades of work. With NFTs, a speculative market implemented this idea in the digital sphere, leading to increased discussion within the artworld. Artists such as Oscar Santillán have offered commentary on how the traditional art system can be improved through blockchain, including the implementation of PABs (Physical Artworks on the Blockchain).4 He claims that the artworld doesn’t have to be a “poverty making machine.”5 The passive income earned from royalties offers artists time to research, read, and experiment in order to improve their practice. Yet, NFTs were not the correct place to first implement ethical conditions as their exponential growth and early optimism was based on an artificial economy of bloated speculation and unsustainable infinite growth. In autumn 2022, several NFT platforms removed royalties from artist contracts when the speculation bubble burst.6 Artist royalties on sales of works with decreasing values was driving clients away from platforms who sustained this practice.

What makes Siegelaub’s proposal in 1971 possible is a deep knowledge of the art market and how value accumulates in relation to an artist’s practice. The proposal of a 15% royalty to an artist for increased value considers the lasting value held in a work for the collector because there is no loss of money involved for patrons as long as the work remains at its original value. If an artwork sells for the same value of purchase, the artist does not make gains, nor does the collector, but at least the collector recaptures their original expenditure. However, if the price of the artwork doubles or triples, both the collector and the artist see economic profits. Artist royalties are a way for collectors to continue supporting an artist even when they are decommissioning their artwork from the collection—something generally seen as a negative contribution to the artist’s value. What NFT platforms got wrong was that they applied the royalty to the total sale value, meaning that even if the NFT maintains its original price, the collector could not retain the artwork’s full value. Although this explanation is a bit simplified due to platforms generally charging a transaction fee or a sale percentage it helps to explain why so many NFT platforms removed artist royalties when growth went down. But royalties are still a valuable idea to pursue and the art world is in need of strategies to help artists achieve sustainable income to support their practices.

NFTs have, however, renewed the discussion on royalties in the public sphere. Through the introduction of smart-contracts, and the direct contact between artists and markets, makers can feel actively involved in setting up their sale contracts transparently. This, coupled with values firmly grounded in cultural value rather than speculation, can promote steady growth rather than immediate and explosive gains that are bound for decimating crashes. Smart contracts are an ideal way to enforce the transparency and completion of ethical transactions. These contracts legally bind transactions into a pre-established contract and use algorithms to block the completion of a transaction until all of the prerequisites are upheld. The transfer of a DAB or a PAB could therefore be paused until the new owner has given the established artist’s royalty and signed the conditions of sale. This method of transferring ownership helps artists by establishing transparent industry-wide practices and holding people accountable for their ethical considerations towards artists.

Smart contracts contain additional benefits even for young commercial galleries. It is uncommon for blue-chip galleries to take on artists directly from art school. Typically, promising young talents go through project spaces, young galleries, mid-sized galleries, and finally to established ones. Along the way, the early spaces make important investments and take risks that are enormous in relation to their annual turnover compared to what a blue-chip will put into an artist’s production. Yet, these spaces that are fundamental for supporting young talents often never see returns because larger spaces will offer a bigger platform to artists who succeed before their demand becomes profitable. With smart contracts, a percentage of resales could also support young galleries so that when artists move up, their works that entered collections in the early years will also contribute to supporting the platforms that initially supported and invested in their talent.

As a ledger system, blockchain is a solution to one of the biggest problems in the history of art: provenance. On Collecteurs, we have recently focused on the issue of repatriation that continues to be the subject on the frontier of the ethics of collections. The problem with provenance often has to do with murky or untraceable movements and the unclear conditions of sale of artworks. Through the blockchain not only can new contracts be created, but collectors can also create ethical smart contracts that can retroactively introduce these principles into already-acquired artworks by transferring certificates of authenticity into PAB tokens.

The ethical potential of blockchain is therefore enormous - collectors have the power to create new smart-contracts with the consent of artists and original galleries of sale that will grant royalties to these actors in future sales of the artwork by transferring their existing collections into PABs, which are essentially certificates of authenticity on the blockchain. Sometimes it takes decades to implement the proposals that activists and organisations propose. Perhaps during that time, general discourse warms up to the idea, or technology offers new solutions that were previously impossible. This year, Collecteurs has launched CollecteursX - a digital marketplace that aims to create a new, ethical, culture-based response to new trends in Digital Art. With an integrated editable smart-contract, artists and galleries can create and trade pieces of digital art through our partnership with eco-friendly Algorand blockchain. Our aim is to create a responsible alternative to the speculative models that put artists first and support the infrastructure that makes the art world function. With the introduction of blockchain into our everyday lives, we should honour Siegelaub and Projanksy’s work by using our new capabilities to further their efforts for a fairer and more equitable art world.

Illustrations by Berke Yazıcıoğlu.